Refundable One Time Payment Code

Overview

Google Standard Payments supports cash-based FOPs (forms of payment) like convenience store purchases (such as a 7-Eleven). At a high level, a user who wants to pay for goods generates a reference number through the Payment integrator. The user then takes this reference number to a convenience store, kiosk, or bank and pays the reference number.

|

|

|

Concepts and terminology

Símbolos e Convenções

As palavras-chave “PRECISA”, "NÃO PODE", "OBRIGATÓRIO" "SHALL", "NÃO DEVE" "DEVERIA", "NÃO DEVERIA", "RECOMENDADO", "MAIO", e "OPTIONAL" nestes documentos devem ser interpretados conforme descrito em RFC 2119.

Carimbos de data/hora

Todos os carimbos de data/hora são representados em milissegundos desde a época Unix (1o de janeiro de 1970) em UTC.

Exemplo:

- 23 de abril de 2019 20:23:25 GMT = 1556051005000 milissegundos

- 16 de agosto de 2018 12:28:35 GMT = 1534422515.000 milissegundos

Valores

Os valores monetários nessa API estão em um formato chamado "micros", é um padrão no Google. Micros são um formato de precisão fixa baseado em números inteiros. Para representar um valor monetário em micros, multiplique o valor da moeda padrão por 1.000.000.

Exemplo:

- US$1,23 = 1230.000 microUSD

- US$0,01 = 10.000 microUSD

Idempotência

Todas as chamadas de método nessa API precisam ter comportamento idempotente. O Google vai repetir as solicitações esporadicamente para garantir que as transações estejam no mesmo estado nos dois lados. Os integradores não podem tentar reprocessar solicitações que já foram processadas. Em vez disso, a resposta do processamento bem-sucedido deve ser informada. Todos os métodos têm um RequestHeader comum que contém um requestId. Esse requestId é a chave de idempotência para todas as chamadas.

Qualquer resposta não terminal (uma não HTTP 200 bem-sucedida) não pode ser processada de forma idempotente. Portanto, uma solicitação que antes recebeu um erro 400 (solicitação inválida/pré-condição com falha), quando chamada uma segunda vez, não pode retornar 400 de maneira idempotente e precisa ser reavaliada. Na reavaliação, ele pode retornar um erro 400 ou ser processado com êxito.

Para mais informações sobre idempotência, consulte este guia detalhado.

Integrador

Uma empresa que usa a plataforma de pagamentos do Google. Pode ser interna (própria), como o YouTube ou o Google AdWords, ou uma empresa externa (3P) que quer integrar o próprio serviço para trabalhar com o ecossistema do Google.

Forma

Forma de pagamento. Isso é mais geral do que um instrumento. Visa, MasterCard e PayPal são FOPs.

Instrumento

Uma instância específica de uma forma de pagamento feita por um cliente específico. Por exemplo, o cartão de crédito de um usuário ou a conta do PayPal. Uma FOP tokenizada para um determinado cliente também é um instrumento, porque é uma instância de uma forma de pagamento para esse cliente, armazenada com segurança em nosso sistema.

Token

Uma representação, no sistema do Google, da forma de pagamento de um usuário específico. Como ele contém todas as informações necessárias para fazer uma compra, um token também é um instrumento. Isso pode incluir informações como um número de conta que um usuário tem com o integrador.

Key flows

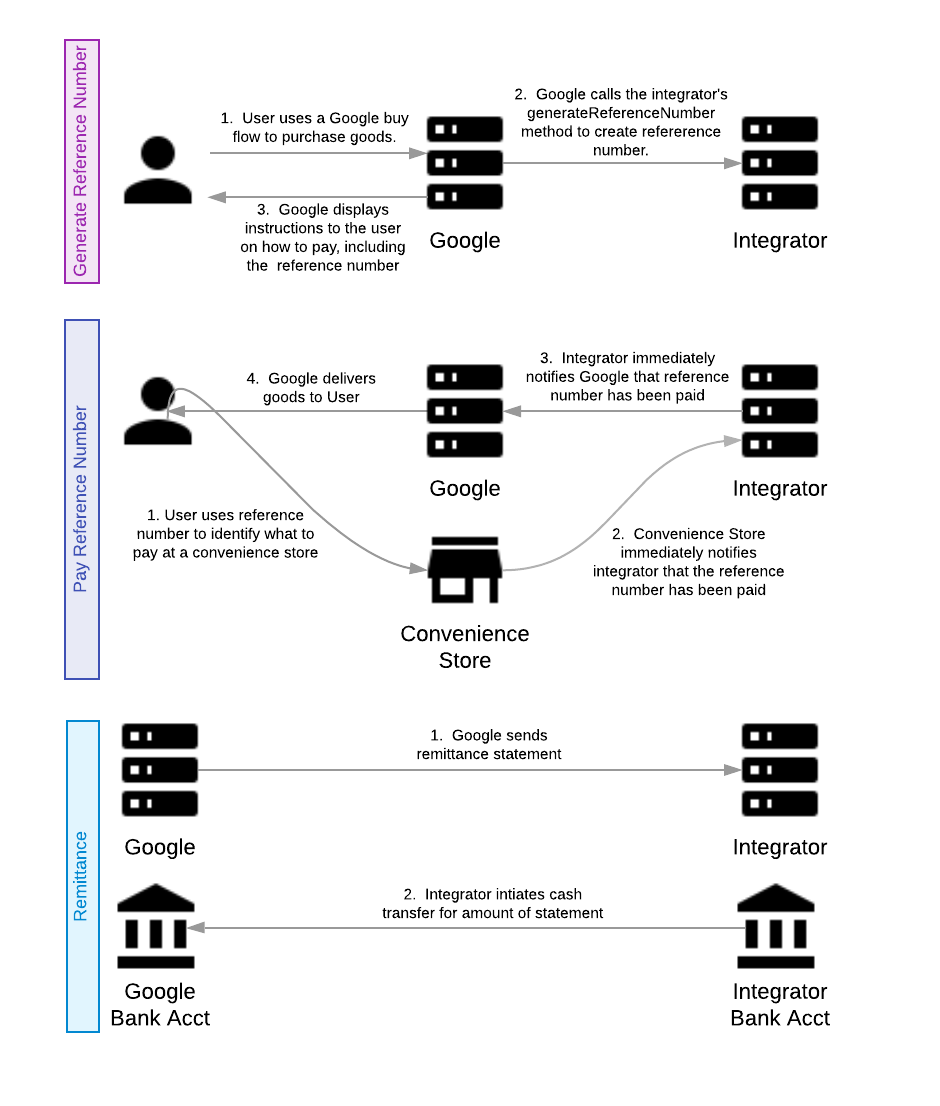

Google uses two key flows to create and pay these reference numbers:

- Generate Reference Number Flow.

- Pay Reference Number Flow.

Later, reconciliation and settlement from resulting purchases are handled by the remittance flow.

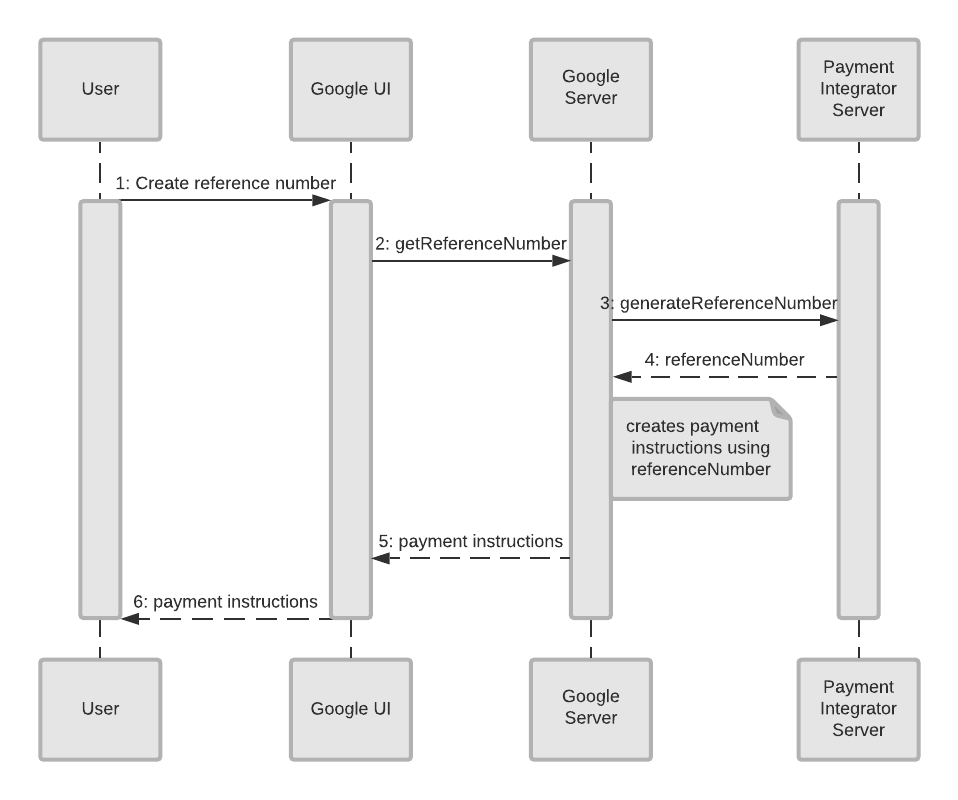

The diagram below illustrates each of these flows.

Cash FOP overview

The first two flows are described in more detail in the following sections. See the Remittance flow page if you want to know more about that flow.

Generate reference number

The purpose of the generate reference number flow is to create and exchange an identifier (reference number) that both Google and the integrator can use to identify a purchase. The user can then use this reference number at a convenience store, kiosk, or bank to complete the purchase. This identifier is generated by the integrator at Google's request by calling the generateReferenceNumber method. The request for generation of the reference number includes an amount and a transaction description.

The following diagram illustrates how a reference number is generated and sent to the customer with instructions.

Generate reference number flow

Here is a list of the objects and what they represent:

- User: This is the person who wants to pay for something using this form of payment.

- Google UI: This is the interface where the User makes their purchase. It could be through the web or through an app.

- Google Server: The backend server at Google that requests the generation of the reference number and creates payment instructions for the user.

- Payment Integrator Server: The backend server of the Payment Integrator that keeps track of the payment details and generates the reference number.

This flow begins with the user who wants to use this cash form of payment.

- The User accesses the Google UI which sends sends a request for a reference number.

- The Google UI sends a message to the Google Server that it needs a reference number (

getReferenceNumber). - The Google Server asks the Payment Integrator Server to generate a reference number (

generateReferenceNumber). - The Payment Integrator Server generates and sends the reference number to the Google Server.

- The Google Server creates payment instructions to go along with the reference number. Then it sends this information to the Google UI.

- The Google UI sends these instructions and reference number to the User.

Notes on reference numbers

Reference numbers can only be paid once, and they can be cancelled through the cancel reference number flow. Also, reference numbers must be alphanumeric, and it must support multiple display formats.

In addition to displaying the reference number, Google's UIs can optionally represent the reference number in the Code 128 format (a barcode format). Other barcode formats can be supported by request.

Pay Reference Number

The user will use this reference number at a convenience store, kiosk, or bank to identify the purchase the user wants to pay for. The integrator should have the user confirm the purchase being paid by displaying the purchase amount, date, and transaction description prior to paying.

Once the user chooses to pay, they must pay in full, and only pay once. This API does not support over or under payments on a single reference number. Multiple payments to a single reference number is also not supported.

Once the user pays, the integrator must immediately notify Google that this reference number has been paid via the referenceNumberPaidNotification

Once paid, the reference number and amount will be included in the remittance statement sent on T+2 days.

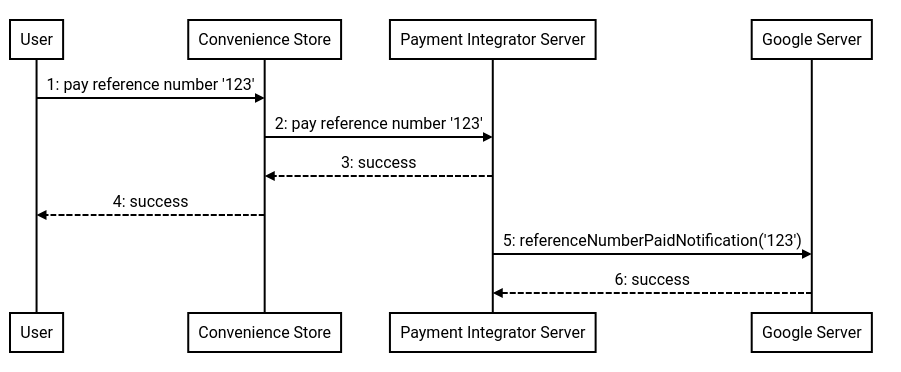

Here is a sequence diagram that illustrates the payment of a reference number.

Pay reference number flow

The objects in the diagram represent the following:

- User: This is the person who wants to pay for something using this form of payment.

- Convenience Store: The location where the user makes their payment using the reference number and instructions given, such as a convenience store.

- Payment Integrator Server: The backend server of the Payment Integrator that keeps track of the payment details.

- Google Server: The backend server at Google that requests the generation of the reference number and creates payment instructions for the user.

This flow begins with the user who goes to a convenience store in order to make a payment according to the instructions given to them.

- The User goes to a Convenience Store to make a payment.

- After the transaction is complete, the convenience store notifies the payment integrator of payment.

- The Payment Integrator Server sends a success message to the Convenience Store.

- The Convenience Store conveys that the transaction was a success to the User, and the goods will be delivered to the User soon.

- The Payment Integrator Server sends a message to Google’s Server that the reference number has been paid (

referenceNumberPaidNotification - The Google Server responds with a message of success to the Payment Integrator Server.

Cancel reference number

Reference numbers can be cancelled by Google. If Google cancels a reference number, the cancelReferenceNumber method will be called. Upon successful return of this call, it is invalid to pay that reference number, and the integrator must refuse payment for this number. Upon success of this call, all future calls to the referenceNumberPaidNotification

If the payment process has already started, for example if the user has entered their reference number into a kiosk but has not yet paid, the integrator should return a HTTP 423 response code with ErrorResponse containing [USER_ACTION_IN_PROGRESS][google.standardpayments.v1.ErrorResponse].

Refund

Paid reference numbers can be refunded by Google using the request ID of the original generateReferenceNumber call (note that refunds will NOT use the reference number). If Google refunds a reference number, the refund method will be called. This method can be called multiple times with amounts totalling less than or equal to the original paid amount.

Next: Remittance flow