Overview

The purpose of the Chargeback Alert Proactive Refund flow is to prevent chargebacks from being filed by giving Google the opportunity to proactively refund a transaction before a chargeback is filed. This potentially reduces the processing fees for cases that Google does not expect to win, but, more importantly, when the customer actually is the victim of payments fraud, provides a better experience by returning the money to the customer more quickly.

This is a synchronous API -- the vendor will receive a response with a decision directly to their request.

Flow sequence diagram

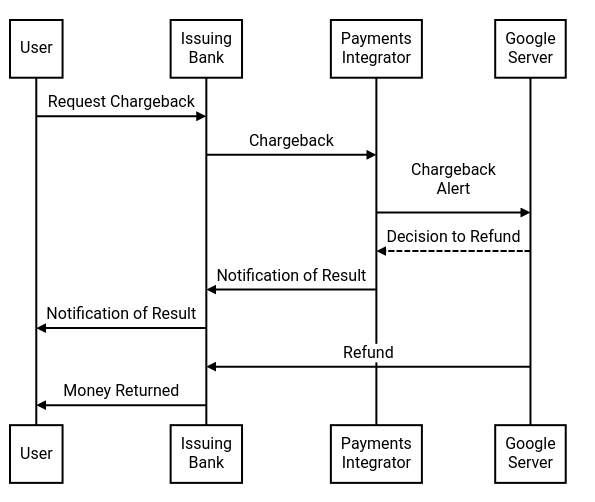

Here is an example flow in the case where the transaction is refunded:

The objects in the diagram are:

- User: This is the person who wants their money back.

- Issuing Bank*: the financial institution that issued the credit card to the user.

- Payment Integrator: The integrator that files the chargeback alert with Google.

- Google Server: The backend server at Google that receives the chargeback alert and decides whether or not to proactively refund the transaction.

In this example Google issues the refund.

- The user initiates a chargeback with their bank.

- The issuing bank communicates this chargeback with a payments integrator (several intermediaries are omitted here for simplicity).

- The integrator sends a ChargebackAlert to Google by requesting that the transaction be proactively refunded.

- Google evaluates the request, and decides to refund the transaction.

- Google synchronously replies 'REFUNDED' to the integrator. The refund will (likely) not be fully processed at this time, since it takes some time.

- This decision is propagated back down to the issuer (and possibly the user). This may be asynchronous.

- Asynchronously, Google refunds the transaction.

- The issuing bank returns the money to the user.

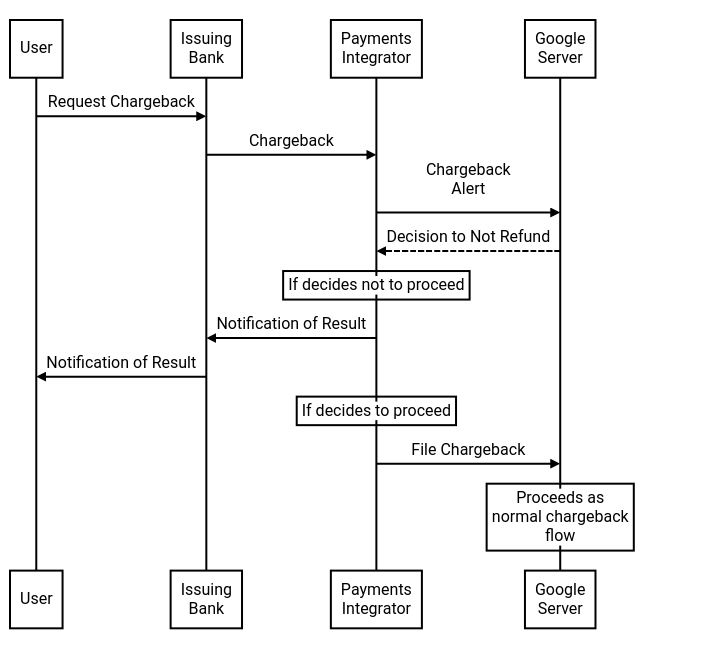

Here is an example flow in the case where the transaction is not refunded:

- The user initiates a chargeback with their bank.

- The issuing bank communicates this chargeback with a payments integrator (several intermediaries are omitted here for simplicity).

- The integrator sends a ChargebackAlert to Google by requesting that the transaction be proactively refunded.

- Google evaluates the request, and decides that the transaction should not be refunded.

- Google synchronously replies 'NOT REFUNDED' to the integrator.

- This decision is propagated back down to the issuer (and possibly the user). This may be asynchronous.

- If the integrator decides to proceed with the chargeback, then they (or another party) file a chargeback with Google, which Google will (likely) represent. This proceeds as in standard chargeback flows, and the details are omitted here for simplicity.